In early December, according to the latest market quotes, the average spot price of electric-type lithium iron phosphate exceeded 90,000 yuan / ton, an increase of 3,000 yuan / ton from last month, a new high in three years!

At the same time, due to continued strong demand in the downstream market in the fourth quarter, the iron-lithium supply gap is still there, and the price of iron phosphate in the lithium continues to increase with the price of raw materials by the end of the year.

In addition, as the price of materials increases, on the one hand, the expansion of lithium iron phosphate battery capacity of battery manufacturers continues to accelerate, and the increase in the price of iron-lithium batteries will increase l 'next year ; on the other hand, lithium iron phosphate and investment in raw materials continue to become the popular lithium battery industry.

Expansion speed of lithium iron phosphate battery and increase in price

On the demand side, Tesla and many other automakers have chosen lithium iron phosphate batteries for support installations. Battery companies run by CATL have frequently received orders for LFP batteries.

As for car manufacturers, Hyundai, Volkswagen, Daimler, Apple, etc. all plan to use lithium iron phosphate batteries, and popular domestic models such as Great Wall, Xiaopeng, Nezha, and Zero Run have also replaced lithium iron batteries.

In terms of orders, in October of this year it was reported that Tesla had reserved 45 GWh lithium iron phosphate batteries from CATL for next year's sales plan, primarily for the Model 3 and Model Y. In addition to pre-ordering 45 GWh batteries from CATL, Tesla also plans to place additional orders.

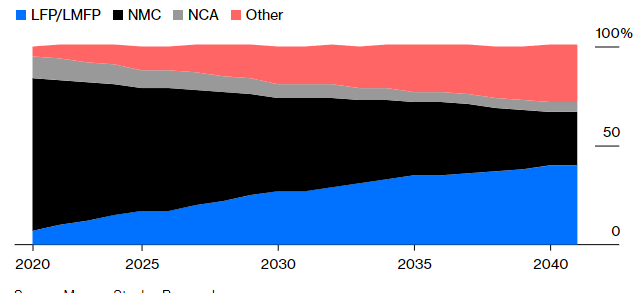

At present, the national installed capacity of lithium iron phosphate batteries has exceeded that of ternary batteries for several consecutive months. It is estimated that China's installed capacity of lithium iron phosphate will be 60% of installed capacity in 2025, and the long-term global penetration rate of lithium iron phosphate is expected to reach 35%.

In order to meet booming downstream demand, electric battery companies also rapidly increased the proportion of lithium iron phosphate expansion.

Regarding CATL, in April this year, CATL Chairman Zeng Yuqun said that the proportion of lithium iron phosphate batteries will gradually increase in the future, and CATL will increase the production capacity of lithium iron batteries.

For BYD, the company will expand its base in Chongqing in 2021 and build new bases in Changsha, Guiyang, Bengbu, Changchun, Jinan, etc. The production capacity of blade batteries is expected to approach 60 GWh by the end of 2021..

Regarding Yiwei lithium power, on November 5, the company plans to invest 6.2 billion yuan to build a large 20 GWh passenger car cylindrical battery project and a square lithium battery project. 16 GWh iron phosphate in Jingmen; On November 12, the production capacity of the company's 14 GWh lithium iron battery was put into production; on november 29, the company's 50 GWh lithium iron phosphate battery project was signed in Chengdu.

In addition, LG New Energy, SKI and other international electric battery giants have also made it clear this year that they have started rolling out lithium iron phosphate batteries and planning new production lines.

At the same time, the strong increase in demand in industry has intensified supply imbalances, in particular the "resurgence" of lithium iron phosphate batteries is transmitted to the upstream material end, leading to the continuation of the rise in the price of raw materials and the cost of lithium batteries also increased. If it is calculated according to the material quotation, taking as an example the classic 523 square lithium iron phosphate battery cell, its cost will increase by 62%.

Recently, it has been said that the Ningde era, which has the strongest ability to control the costs of the industrial chain, has raised prices. Before that, many electric battery companies issued price increase letters, including BYD, Penghui Energy, Guoxuan Hi-Tech, Zhuoneng New Energy, etc. Lithium iron phosphate battery prices are reported to have increased 10-20% since September. .

In addition, clues can also be found in the tender for the China Tower 2 GWh lithium iron phosphate battery project in 2021. Among the ratings of the winning candidates, the highest rating increased by 0.3 yuan / Wh compared to February.

Industry insiders have said that next year, the price of lithium battery materials is expected to remain high, the cost of lithium batteries is still difficult to control, and the price increase of battery manufacturers is expected to remain high. also imperative. At the same time, in order to ensure the smooth running of the production schedule for next year, automakers are more likely to accept price increases.

Investing in lithium iron phosphate has become a hot spot

It can be seen that, given the high certainty of demand for lithium iron phosphate, the imbalance between supply and demand has prompted more capital to enter building materials upstream, and relative to other industry chain materials